Why HIAPAC?

Our Service Offering

HIAPAC is a full-service hospitality and tourism advisory business based in Bangkok, focusing on off-market opportunities in South East Asia (SEA), Europe, Africa and Caribbean.

Target assets usually reside within the following regions, however may be owned off-shore or in listed vehicles:

- SEA ex-India

- East Africa

- Mediterranean (all countries); and

- Caribbean

HIAPAC provides a full spectrum of services to its clients:, including:

- Buy-side - Asset sourcing for purchase or management;

- Sell-side - Buyer identification and process management;

- Private capital - access to strategic and dedicated hospitality capital as required;

- Listed capital - REIT connections and expertise;

- Access to institutional capital.

Our Typical Roles

These transactions typically involve:

- Off-market hotel sales

- Investment into off-market hotels

- Joint venture partnerships in off market hospitality situations

- Leasehold negotiations for hotel investors and joint venture partners

- Management agreement negotiations for hotel operators

- Green and brownfield hospitality investments

- Capital markets solutions involving investment trusts for private equity and institutional investors.

Team

HIAPAC's team of in-house professionals and network of joint venture partners have extensive experience in hospitality investment and development as well as mergers and acquisitons and capital markets.

We are supported by a network of professional consultants, covering regional and market specific, legal, financial, banking and development advisory.

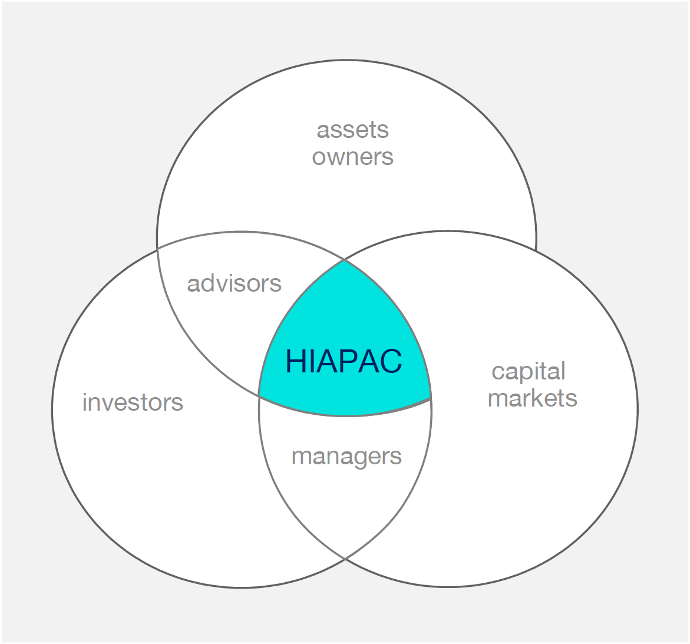

Through its broad network of contacts and associates, HIAPAC accesses the full spectrum of industry decision-makers

Methodology - Threshold to Recommend an Opportunity

HIAPAC has deep knowledge of each opportunity proposed

This is either via knowledge or access to the vendor, financier, pricing or counter party

Each opportunity resides within an ‘appropriate’ value range given the current market and is considered possible